2023 Spring Market Update

Spring Market Update

A sense of stability..?

Welcome to PMC’s Spring Insights.

A run of consecutive interest rate pauses has brought about a sense of stability in the market. However will that last with a high probability of another interest rate rise next week…?

Below our team have summarised what we are witnessing on the ground in our core markets, and how we predict the market closing out in 2023.

QUICK FACTS

- The combined value of residential real estate in Australia climbed to $10.1 trillion at the end of September (CoreLogic)

- Of the total value of residential dwellings, $9,694.8 billion was owned by households (95.9%) (ABS)

- These statistics have a large bearing on why residential property is typically experiences low volatility in values

GENERAL MARKET INSIGHTS

- As we predicted in our winter market update, the surge in stock leading into Spring hasn’t really materialised in our local markets in Sydney or Brisbane

- No doubt certain pockets have experienced an increase in listings. But quality property is still in low supply, and we don’t believe this will change in the medium term

- The RBA’s fourth consecutive cash rate hold at 4.1% has provided a lot more certainty for buyers. Even if another rate rise is likely.

- We are now well and truly into the “fixed rate mortgage cliff” period and the great news is that the vast majority of households are coping with the transition with mortgage arrears remaining at near historical lows (although there are some early signs of this increasing)

- The RBA expects mortgage arrears to rise further. However it’s likely to remain very low based on historical levels – this is positive news for the market and should create further certainty for buyers and sellers

- The RBA stated “the vast majority of borrowers rolling off fixed rates have managed the transition to higher rates well. In fact, arrears rates for recent fixed rate refinances are similar in magnitude to long standing variable rate borrowers”.

- Sydney median prices are up 7.3% for the current calendar year, as at 30th September 2023

- Brisbane median prices are up 6.2% since February this year and in some areas, the prices have surpassed the peak from May 2022

SYDNEY

Note; our commentary is specifically focused on the Northern Beaches and North Shore markets that we specialise in.

ON-THE GROUND OBSERVATIONS

- Demand for our services has been strong leading into Spring with a renewed sense of urgency from buyers

- The price point with the deepest buyer pool tends to be in that $1.8M – $3.0M bracket – leading to increased competition for well priced properties within this range

- The activity in the market is very segmented with entry level houses (sub $3.0M) and entry level apartments (sub $1.5M) again seeing the strongest activity and prices increasing accordingly

- The prestige market still remains strong. Trophy homes on the water or with big views are still achieving record prices, although if a property doesn’t tick most of the boxes that prestige buyers demand, we are noticing this type of property is starting to take longer to sell or being withdrawn from the market

- With the turnaround in prices that have occurred this year, we have observed a number of buyers that took a “watch and wait” mentality (often listing to the expert economists property price predictions) now firming up their briefs and re-entering the buying phase with some urgency

- We often witness a trend with those that are too close to the financial markets or too “in the know” trying to time the market… and history has shown that this can hurt this type of buyer who doesn’t take a long term approach to their property plans with the bottom of the market passing at the beginning of 2023

RENTAL INSIGHTS

- The rental market continues to be very buoyant. Particularly on the Northern Beaches as we head into the warmer months

- We have leased a number of apartments below $1,200 per week after the first open house and often above the advertised price

- Nationally, CoreLogic reported “continued shortfall in rental listings saw the national vacancy rate reduce to a new record low of 1.1% in September as the total count of national rental listings fell to its lowest level since early November 2012”.

- National rents have risen for 38 consecutive months, taking rental values 30.4% higher since July 2020

BRISBANE

Note; our commentary is specifically focused on the residential market within 15km radius of the Brisbane CBD.

ON-THE GROUND OBSERVATIONS

- The Brisbane market has continued to go from strength to strength since our Winter update

- Spring has seen investors re-enter the market with a renewed sense of urgency to buy. Especially in the inner to middle ring suburbs with a sub $1,200,000 price range for houses, and sub $1,000,000 for apartments and townhouses

- Rental yields are still approximately 1-1.25% below historical averages for houses and approximately 1% below historical averages for apartments. Which is primarily due to the fact values are continuing to strengthen and the rents are not having the opportunity to catch-up, despite low vacancy and strong growth in rental values

- The apartment and townhouse market demand is so strong that its not uncommon to witness 30-35 groups at the first open homes, often resulting in multiple offers within 24-48 hours of the open

- The inner-city ring (within 5-7km of CBD) housing market between $2,000,000 – $3,250,000 is also highly competitive, however buyers are quite particular about their requirements

- Prestige property in Brisbane (north of $3m) is selling surprisingly quickly and in some instances in record selling times. Interestingly, there is a large number of local buyers competing for property with a recent record sale in Chelmer, well in excess of $8M

- In 2022, Brisbane had 82 house sales with values over $5M and so far in 2023 there have been 67 indicating that the prestige market is still very tightly held (CoreLogic)

- PMC’s team are starting to notice that properties that don’t appeal to the majority of the local home buyer market (wrong layout, size, condition) are experiencing lengthier days on market than earlier in the year

- Given the continued low stock levels, prices are continuing to increase which is evident in the fact Brisbane has recorded growth for the last 7 consecutive months

- There appears to be urgency for a lot of people to buy before Christmas and with only 2-3 weeks of new stock being launched, we expect a strong run into Christmas with ongoing price growth in most of the suburbs we specialise in

RENTAL INSIGHTS

- Brisbane has recorded its 7th straight quarter (since Jan 2022) of vacancy rates below 1% indicating a continued undersupply of rental properties

- Demand for rental properties in excess of $1,500pw is slower however most properties are still leased within a 2-3 week period

- SQM research indicates house rents have increased 2.3% in the Sept quarter and units 1.1% continuing to put pressure on renters

- Our teams data indicates that PMC’s portfolio is experience days on market for rentals below 6 days as an average from vacate to new tenants moving in

- Construction has slowed with approvals for new dwellings in SE Qld dropping by 9.1% from June 2022 to June 2023 (QBCC) and loans to owner occupiers for construction have dropped by almost 34% YoY which indicates that we are likely to continue to experience a shortage of housing for the foreseeable future

- Construction starts are down 17.4% (ABS) from the June qtr 2022 to June qtr 2023 so with not only approvals dropping but construction starts as well, supply will continued to be constrained

- Overall, the data indicates it’s not great news for renters however there are a lot of signs that would indicate for those who own investment properties, rents should continue to rise but likely at a more moderate pace

PROPERTY CLOCKS

In conjunction with our research partners, we analyse our Capital Cities and Major Regional Markets to assess where each market is currently sitting in their property cycle. Our property clocks are prepared for our clients and business partners to assist them with making informed property decisions. To request a copy of our most up to date property clock, please click the link below.

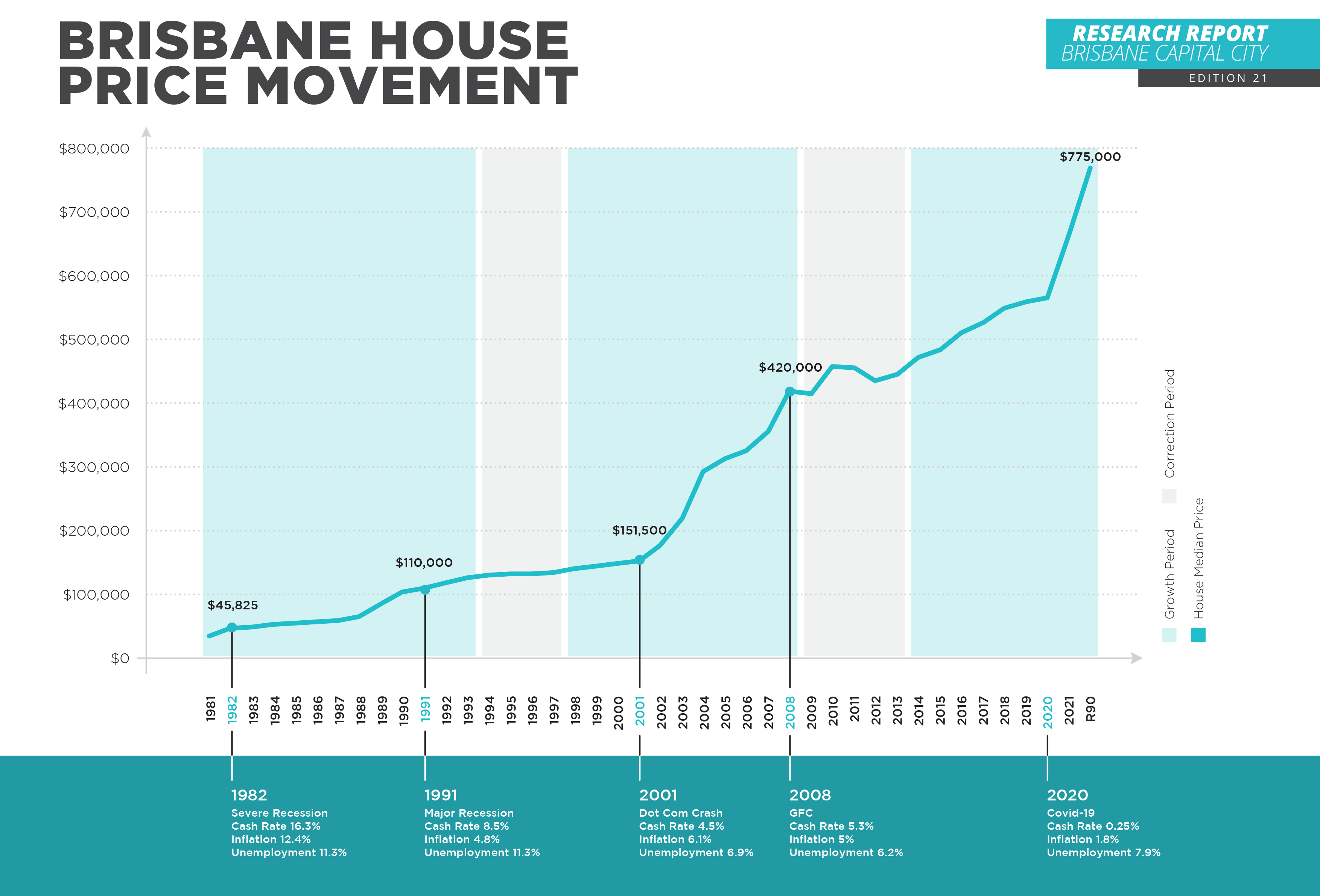

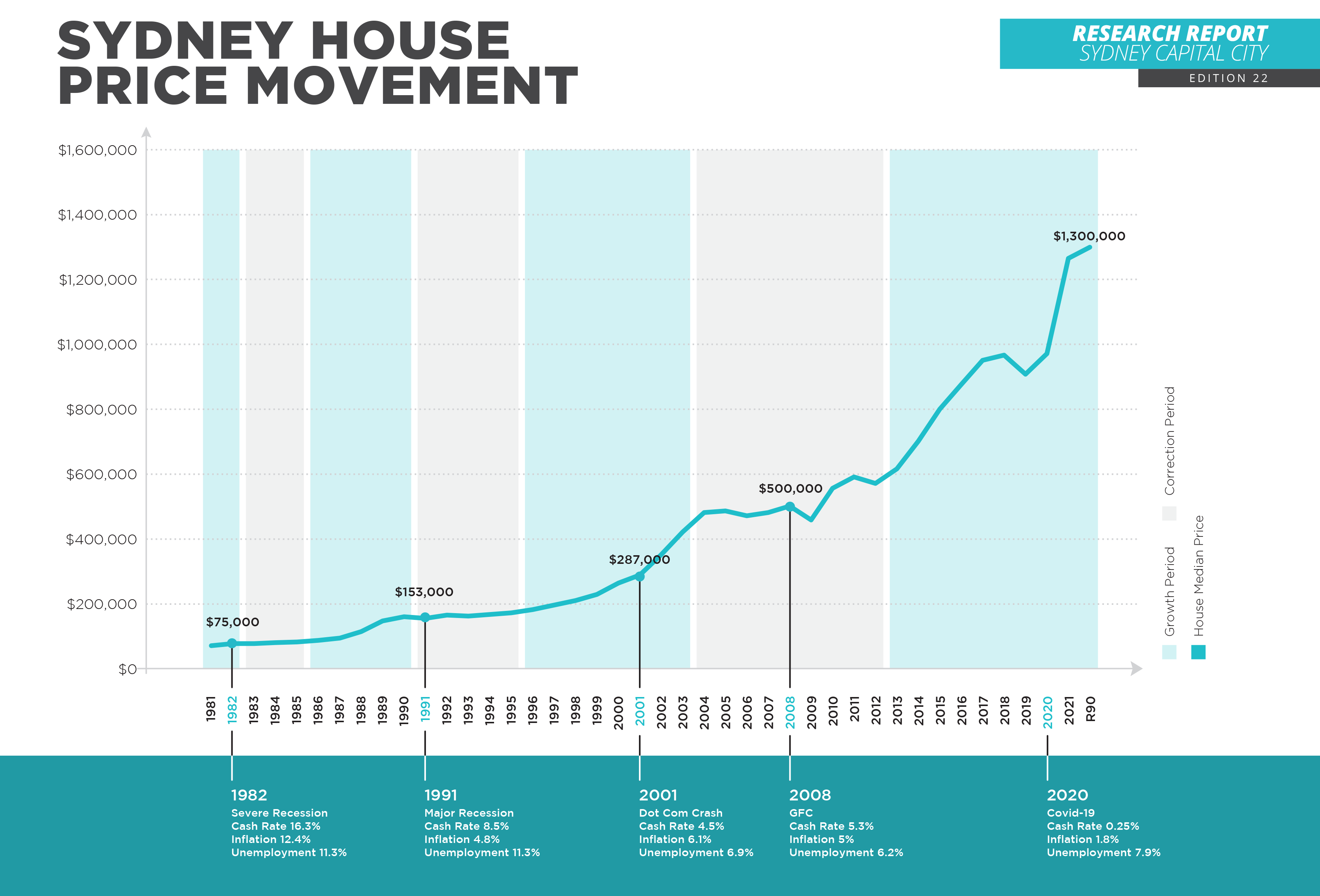

LONG TERM MARKET PERFORMANCE

If you own property in Brisbane or Sydney, the reports below are a great visual representation of the property markets performance over the past 50 years.

KEEP UPDATED

If you are on social media, please click the Instagram or Facebook logo’s below to follow our latest purchases and regular on the ground market updates.

If you are considering buying a new home, an investment property or you require assistance with managing your investment properties, please reach out to our team and we would be happy to discuss your requirements.

We hope you enjoyed our Spring Market update and we will be in touch again in the New Year with our next quarterly insights.

BRISBANE

SYDNEY

Let us empower you to buy with confidence and buy well.

Let our professional team of Buyer’s Agents go on the journey with you.