2023 Autumn Market Update

Autumn Market Update

Debunking the media

Our goal with these updates is to make them informative, concise, and easy to read.

It includes insights of what we are witnessing “on the ground” in the local property markets that we specialise in (Sydney and Brisbane),

not what you read in the media.

We will be sending updates quarterly with our Winter, Spring and Summer editions to follow.

We welcome your feedback on any other topics or commentary you would like us to cover in these market updates.

BRISBANE

Note; our commentary is specifically focused on the residential market within 15km radius of the Brisbane CBD.

GENERAL INSIGHTS

- CoreLogic has reported in April 2023 that the annual decline in Brisbane values has been 10.4% which is significantly lower than the initial predictions by bank economists from early 2022.

- Despite this drop in values, property prices are still 27.9% higher than they were in August 2020 (source: CoreLogic) so a large number of owners have substantial equity in their homes.

- Sale volumes are down 23.8% from Feb 2022 to Feb 2023 (CoreLogic) and two of the most prominent agencies, Ray White and Place, are indicating that their listing volumes are down by close to 25%.

- Population growth is still above historic averages, and this is putting increased pressure on not only property values, but rental values.

- With modifications to rental legislation and higher interest rates, investors have been selling properties which is reducing the available rental supply putting further pressure on the availability of rental accommodation.

- Economists are still predicting declines in value for Brisbane property throughout 2023. Based on what our team are witnessing, we believe these declines would be very modest or possibly even a slight increase in values for the remainder of this year.

ON-THE-GROUND INSIGHTS

- We believe that the Brisbane housing market pull-back finished in November 2022 and since January this year, our buying team feel that Brisbane A-grade housing has actually seen a minor increase in prices.

- Quality A-grade properties are still in very short supply and when available, competition is strong.

- The most competitive market at present is the entry level unit and townhouse markets from $550,000 – $900,000. These listings are seeing in excess of 30-40 groups at the first open and selling within the first week.

- Other competitive markets are Brisbane’s southside houses $1,000,000 – $1,300,000 with similar interest levels to units and townhouses above, and northside houses $2,000,000 – $3,000,000 that are “move-in” ready, selling with multiple offers.

- Most buyers are still hesitant to purchase properties requiring substantial renovation work due to the concerns of not being able to source a builder. So much so, that we’re seeing buyers who have purchased renovators 12-18 months ago who are now selling and buying a home that has already been renovated.

- The prestige market is still faring well, and quality properties are selling for a premium, even to the point of setting new suburb records. Two examples are 38 Newmarket St Hendra which sold for $5,000,000 at auction last week. This had previously transacted for $3,650,000 in Jan 2021 and 27 Martha St, Camp Hill which sold for $4,550,000.

- From conversations with agents and vendors there is no sign that there will be an increase in available housing for sale so the tight supply is likely to continue for the short-term.

- From the enquiry we are receiving, many ex-patriate clients are returning to Australia and instead of heading back to Sydney and Melbourne, are looking to re-locate to Brisbane.

RENTAL INSIGHTS

- At the date of this update, Brisbane’s vacancy rate is 1.0% (SQM Research) which is well below 3% which is considered a “balanced” market. This indicates Brisbane is significantly under-supplied with rental stock

- Our team feels that Brisbane’s rental prices have increased between 10% – 15% (suburb dependent) since July last year

- We feel the peak pricing for rentals occurred in January & February this year and there has been a stabilisation of rental values since. There are no signs of negative rental price movement at this point

- More tenants are keen to stay and pay an increase than have to find a new property to rent

- A large number of people are applying for properties that our property managers feel are beyond their payment ability

- Numbers at open homes have dropped from 20+ at the first open in Jan/Feb down to 5-10 now. This is still strong enquiry however not the frenzy from early in the year

- Affordability constraints are very apparent – apartments are renting very quickly, houses in excess of $1,000 are taking far longer to rent and much harder to find tenants for

- The market is still under-supplied and most applications we receive are stating that they are moving because the previous property is being sold or owners are moving back in which further exacerbates the supply problem

- In excess of 85% of applications we receive are tenants with pets so landlords will rule out a significant part of their tenant pool if they won’t take a pet (legally now you can’t reject a tenant due to having a pet, you would need to provide a separate reason for not accepting the application)

SYDNEY

Note; our commentary is specifically focused on the Northern Beaches and North Shore suburbs that we specialise in.

GENERAL INSIGHTS

- The market has had a firmer start to the year than we had expected and we believe this is largely related to record low stock levels. As such we are again witnessing a build up of qualified buyers looking for quality property.

- Sydney sales volumes were down 30.6% for the twelve months to February 2023, and the flood of new stock that some had predicted hasn’t materialised.

- It is too early to call with absolute confidence, however we get a sense that the bottom of the market is likely behind us. This will largely be determined by the RBA’s next couple of interest rate moves and possibly even more so, the tone of their commentary and future rate predictions from the bank economists. The market is so heavily influenced by sentiment…

- Sydney’s combined dwellings (houses and apartments) have experienced a 13.4% decline in values for the 12 month period to February 2023. (Source; CoreLogic). If the bottom of the market is near or behind us, this will be a smaller decline than forecast by a number of the bank economists. Louis Christopher from SQM Research seems to be more on the money with his predictions to date.

- Auction clearance rates have been consistently higher over the recent period and have been tracking above their long-term average. This has correlated with the reduction in the reported rate of decline in prices over Jan, Feb and March, with some sections of the market seeing small increases in value.

ON-THE-GROUND INSIGHTS

- The number of parties at open homes has been increasing, although there are still a lot more window shoppers than actual buyers ready to act.

- 3 auctions that we attended last weekend sold well in excess of the vendor and agents expectations. These properties were located in Cremorne, Manly and Dee Why and they all had multiple registered bidders. The common denominator – they were quality A-grade properties.

- In certain pockets of the market, we have witnessed some strong results, illustrating that a lot of buyers have re-adjusted to the current interest rate environment and are eager to move forward with their real estate plans.

- Good quality property is still very hard to come by, therefore competition is strong on A-grade property when it hits the market. We are pouring a lot of energy into our sourcing to try and turn up quality options for our clients – this means working closely with selling agents to try and get a jump on the rest of the market.

- Our referrals and enquiry level to our Sydney office has been buoyant. We believe some of this demand is attributed to the level of frustration being experienced by buyers due to the current low stock levels and their desire to access more off market/pre-market opportunities. Usually this is an early indicator for strengthening competition in the market and strengthening sales results.

- Based on the hundreds of conversations our team are having with agents each week, we don’t foresee a large increase in listings over the back end of Autumn and through winter. This further strengthens our views that the largest proportion of the market pull back is behind us (subject to any larger macro economic or political shocks).

RENTAL INSIGHTS

- The rental market continues to be very tight with Sydney vacancy rates sitting at 1.2% (Source; CoreLogic, Feb 23). For investors this provides opportunity to increase their asking rents.

- Annual growth in Australian rent values was 10.2% in the 12 months to December.

- The lack of supply and ongoing competition is causing rents to continue to increase across houses and apartments. SQM Research statistics suggest that Sydney house rents have increased by 23.4% and apartments by 29.5% over the past 12 months (March 28, 2023).

- Long term tenants are preferring to take on rent increases than vacate and risk becoming part of the competitive pool of tenants.

- Given the increase in immigration and lack of supply of future rental stock, we predict this increase in yields to continue throughout the course of 2023, albeit likely at a slower rate of increase to the record experienced in 2022.

PROPERTY CLOCKS

PMC research and analyse the 32 largest population bases in the country to assess where each market is currently sitting in the property cycle. Our property clocks are prepared for internal use and for our trusted business partners. To request a copy of our most up to date property clock, please click the link below.

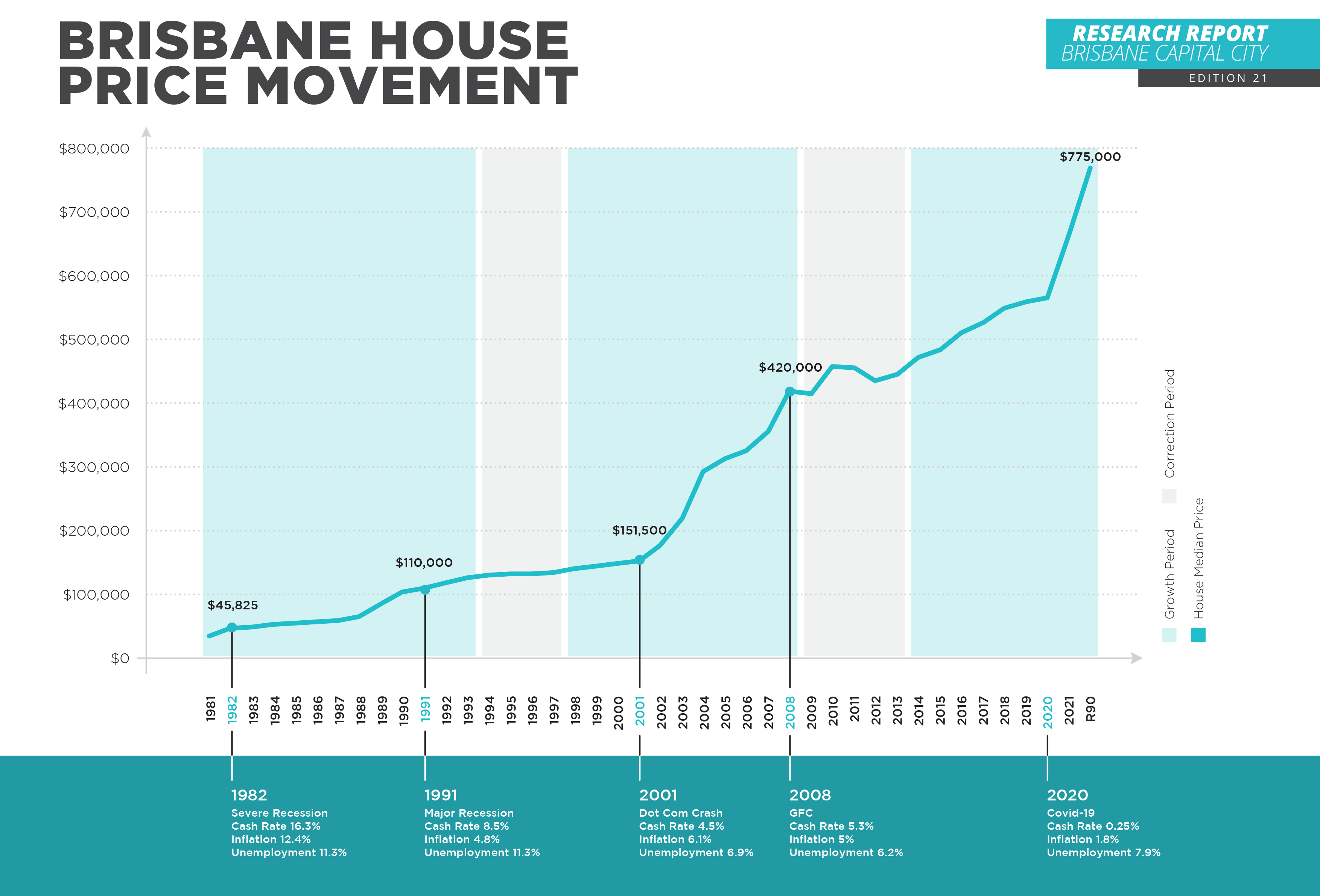

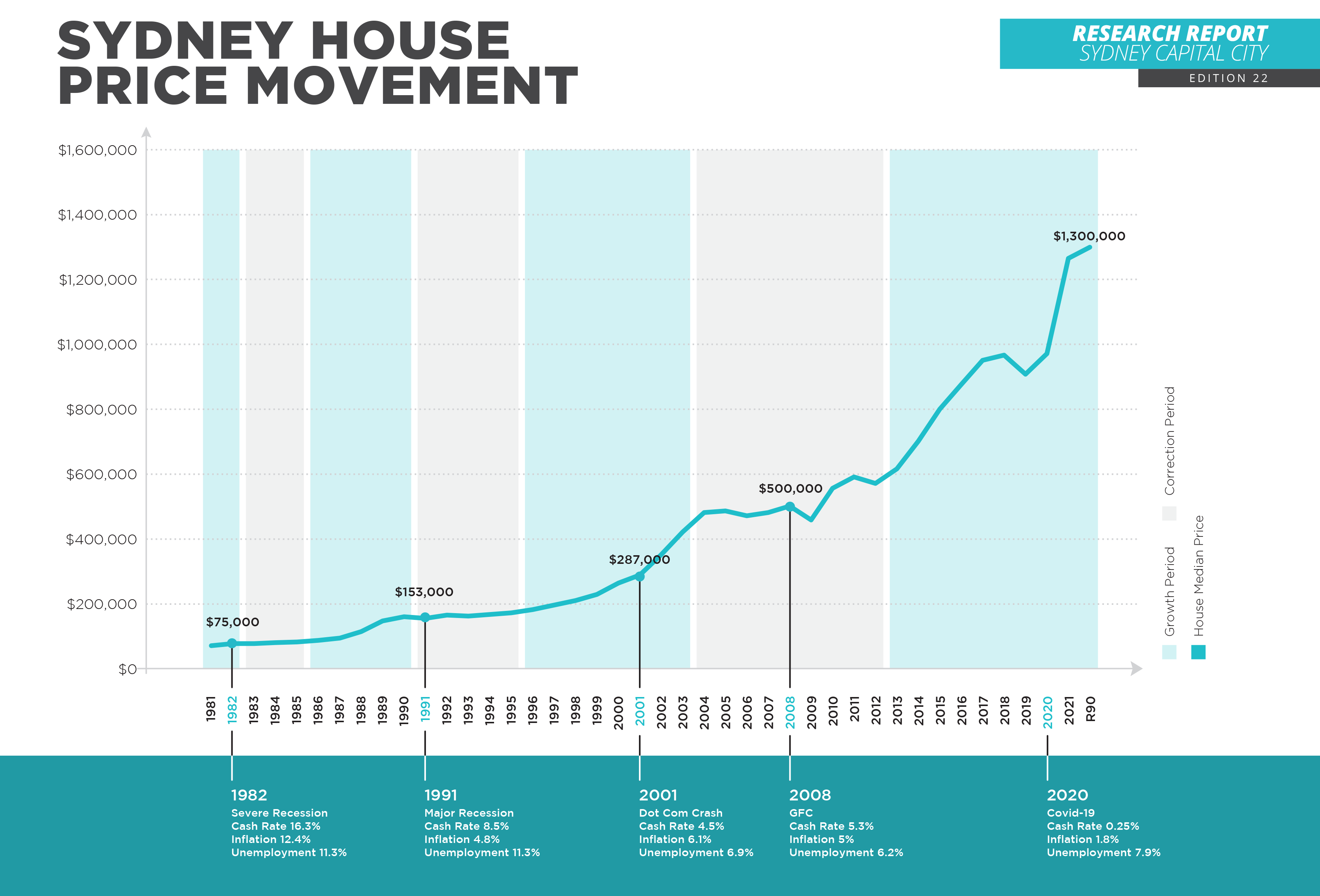

LONG TERM MARKET PERFORMANCE

If you own property in Brisbane or Sydney, the reports below are a great visual represetation of the property markets performance over the past 50 years.

KEEP UPDATED

If you are on social media, please click the Instagram or Facebook logo’s below to follow our latest purchases and regular on the ground market updates.

If you’re considering buying your new home, an investment property or you require assistance with managing your investment properties, please reach out to one of our team and we would be happy to assist you.

We hope you have enjoyed our first market update and we will be in touch again in Winter with our next quarterly insights.

BRISBANE

SYDNEY

Let us empower you to buy with confidence and buy well.

Let our professional team of Buyer’s Agents go on the journey with you.