2023-2024 Summer Market Update

Summer Market Update

What is the early call for 2024…?

Welcome to our first quarterly insights for 2024.

The January long weekend is well and truly behind us, the market is back to full swing and we are now getting asked on a regular basis, “what is the market doing”, “how has the year started”, “what are your predictions for the year ahead”??

The truth is… none of is really know with great certainty. A year is a long time in real estate and as with the events that have occurred globally over the last few years, anything could happen between now and the end of the year. What we can state is that the general consensus from our Sydney and Brisbane teams is that the early signs are that the market appears to be a well balanced market. There is a lot of predictions around interest rate cuts towards the back end of the year and there is no doubt this is starting to play on buyers minds and will likely affect the market sentiment.

Below our team have summarised what we are witnessing on the ground in our core markets and how we feel the year will play out.

QUICK FACTS

- In January, the Australian Property Market just experienced its 12th consecutive month of value rises.

- These results are varied across the country, with Perth, Adelaide and Brisbane being the strongest performers with values increasing at 1% or more per month

- The gap between the median capital city house and unit values has risen to a record high of 45.2% in January

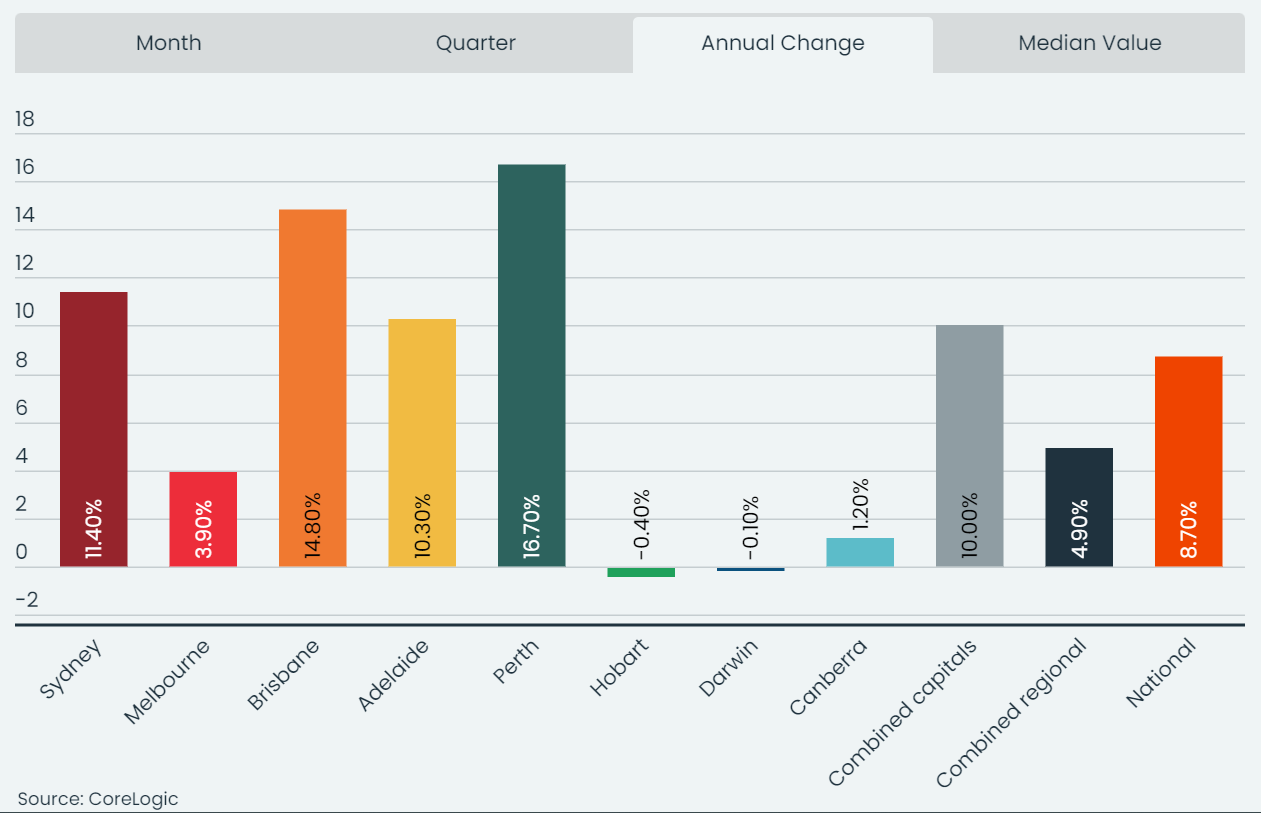

- The Bar Chart below summarises the annual changes in values for every capital city”

GENERAL MARKET INSIGHTS

- 2024 appears to have started with the continued strength in the market that we witnessed at the of 2023…

- The inflation rate is continuing to come down and unemployment is rising slowly which are both signs that we may have seen the end of the interest rate rises and are now eyeing off potential rate cuts towards the 2nd half of the year

- For the year of 2023, Perth was the strongest performing capital city with 16.7% growth, Brisbane was second with 14.8% and Sydney third with 11.4%

- Interestingly, Brisbane’s median house price has now overtaken Melbourne

- As expected, the “fixed rate mortgage cliff” that the doom and gloomers were promoting, hasn’t eventuated with very few distressed sales in the market places that we operate

BRISBANE

Note; our commentary is specifically focused on the residential market within 15km radius of the Brisbane CBD.

ON-THE GROUND OBSERVATIONS

- Since the 22nd of January, buyer demand has been very strong and the momentum we were seeing late last year has continued into 2024 across most price points and asset types

- Buyers are very astute and properties that are over-priced are not selling

- The majority of free-standing houses coming to market between $1m – $1.5m are sold within the first week as both investors, up-sizers and first home buyers compete. Most well presented properties in this range are receiving offers from 7-10 parties

- Townhouses in the 6-7km radius from the CBD are very popular and are now very much seen as the alternative to a low-maintenance, freestanding house. This also correlates with the younger generations often looking for low maintenance housing solutions

- We believe the future supply of townhouses will remain low as most developers are building apartments to maximize their ROI. This should result in increased values for quality townhouses in the years ahead

- The down-sizer/quality 3 bedroom apartment market is extremely popular with one property in Taringa having in excess of 100 groups attend the first two opens and 19 bidders at auction. The demand for down-sizer/prestige apartments is growing rapidly

- Quality 2 bedroom apartments are still in strong demand, primarily due to affordability and housing shortage. This seems to be the strongest and most consistent part of the market at present with solid growth experienced over the past 12 months for quality apartments in small boutique complexes

- Investors have returned in strong numbers with confidence that the peak of interest rates are behind us

- Yields for investment are lower than historical averages even off the back of significant increases in rents over the past 24 months. Gross yields for houses are approximately 3.0-3.5% gross and units are 3.5% – 4.0% gross in the areas that we specialise (inner to middle ring suburbs). These are roughly 1% below long term averages

- The prestige market is strengthening. 2023 saw over 114 properties transact north of $5m whereas 2022 there were only 82. Already in 2024 we have seen 14 transactions north of $5m

- Indooroopilly, Camp Hill, Paddington and Tarragindi, just to note a few, have seen new record sales with $9.25m, $5.5m, $5.8m and $3.75m respectively. Tarragindi’s sale eclipsed the former record by $250,000

- Construction prices seem to have settled and buyers are now more willing to renovate. This has changed from the past 3 years where demand for renovators was very low

- Stock levels are still lower than expected and speaking with the agents, there doesn’t seem to be any likely change in the near future which will result in upward pressure on prices

RENTAL INSIGHTS

- Brisbane’s vacancy rate moved just above 1% in December for the first time in almost 2 years however is back down to 1% for January

- January saw a significant influx of rental applicants resulting in most properties renting above list prices

- PMC rentals had an average increase in rental prices of 13.4% over the past 12 months

- Late last year houses in excess of $1,200 were slow moving however since the start of the year have been renting very quickly

- Currently, the most competitive rental properties are renovated units

- The most competitive rental price is still houses and units sub $750pw

SYDNEY

Note; our commentary is specifically focused on the Northern Beaches and North Shore markets that we specialise in.

ON-THE GROUND OBSERVATIONS

- Buyer enquiry and inspection numbers are strong across the board at the moment, however actual engagement on properties i.e.. Contracts issued, offers etc is not reflective of that, especially on lower graded properties

- There has definitely been a notable increase in the amount of listings, however not as much as everyone was hoping for, particularly quality stock

- We have witnessed a number of listings that were for sale off market pre-Christmas, have now sold (old stock is shifting) at a price in-excess of where interest levels were pre-Christmas

- While we feel like it’s largely a balanced market, we are still witnessing some strong results across all price brackets

- Entry level free standing houses remain competitive

- Budgets between $2.2 – 2.5M on the Northern Beaches are tough with a large buyer pool competing for the same stock

- The “Horse shoe” from Balgowlah, Fairlight, Manly and around to Freshwater and Curl Curl continue to experience strong demand for housing across all price points

- The upper Northern Beaches market is a bit more patchy with average days on market extending beyond the Southern Beaches market

- The Lower North Shore has seen strong results in the downsizer unit market, especially for properties priced below $4M

- The housing market for properties above $5M is performing very well and with new/renovated homes often achieving premiums

- If interest rate cuts materialise in the 2nd half of the year, we expect to see upward pressure on prices, albeit at a moderate rate

- For now the North Shore and Northern Beaches markets appear to be well balanced

- There have been a couple of huge results for houses over the past week with a Soldiers Ave house in Freshwater selling for circa $6.7M, and a house on Ocean St, Manly selling for high $9M’s, both significantly above our assessment of value

RENTAL INSIGHTS

- Rental demand has continued to outstrip supply on the Northern Beaches

- Well priced properties are typically only lasting one open for inspection

- Housing sub $1,600/week is experiencing fierce competition

PROPERTY CLOCKS

In conjunction with our research partners, we analyse our Capital Cities and Major Regional Markets to assess where each market is currently sitting in their property cycle. Our property clocks are prepared for our clients and business partners to assist them with making informed property decisions. To request a copy of our most up to date property clock, please click the link below.

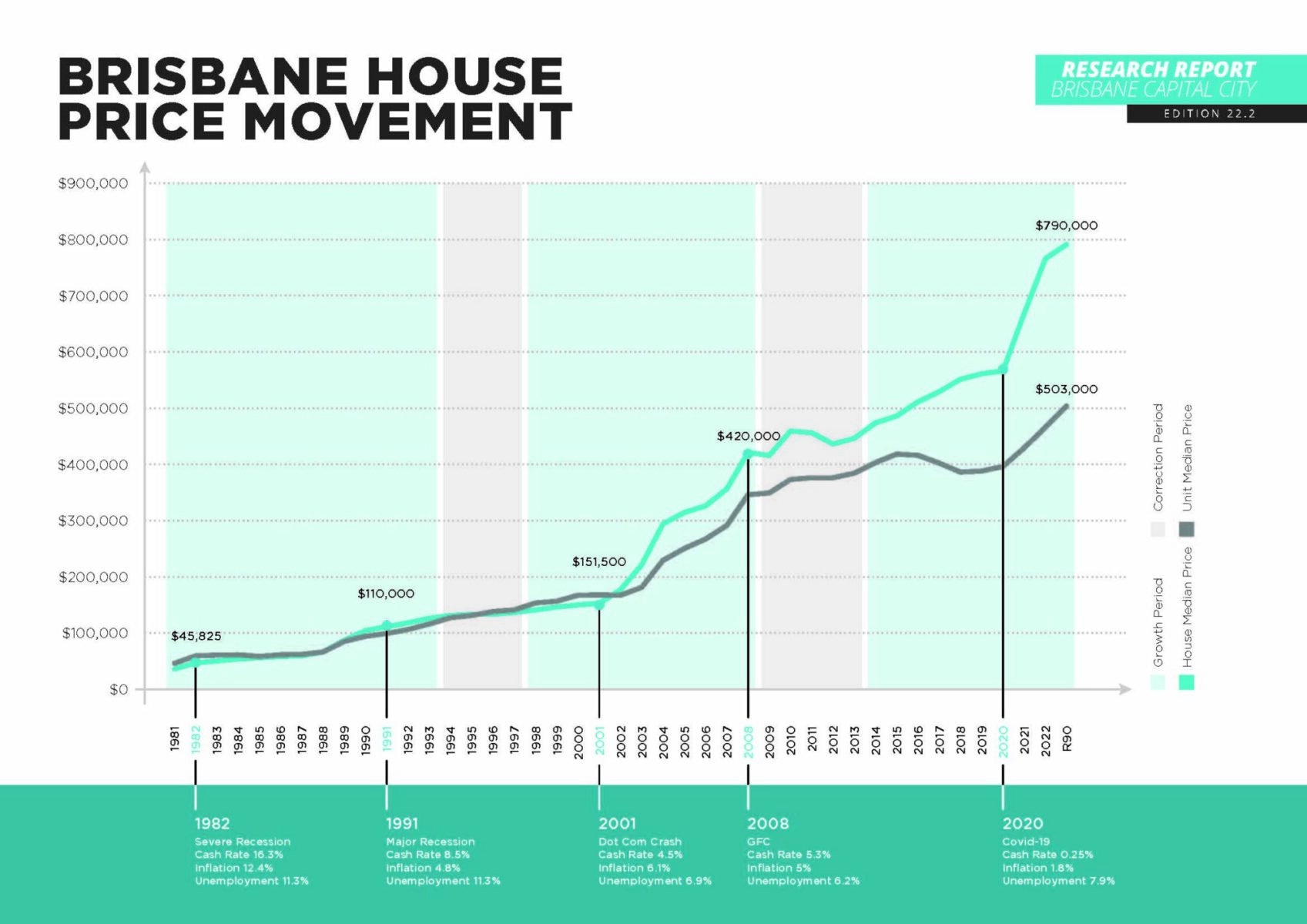

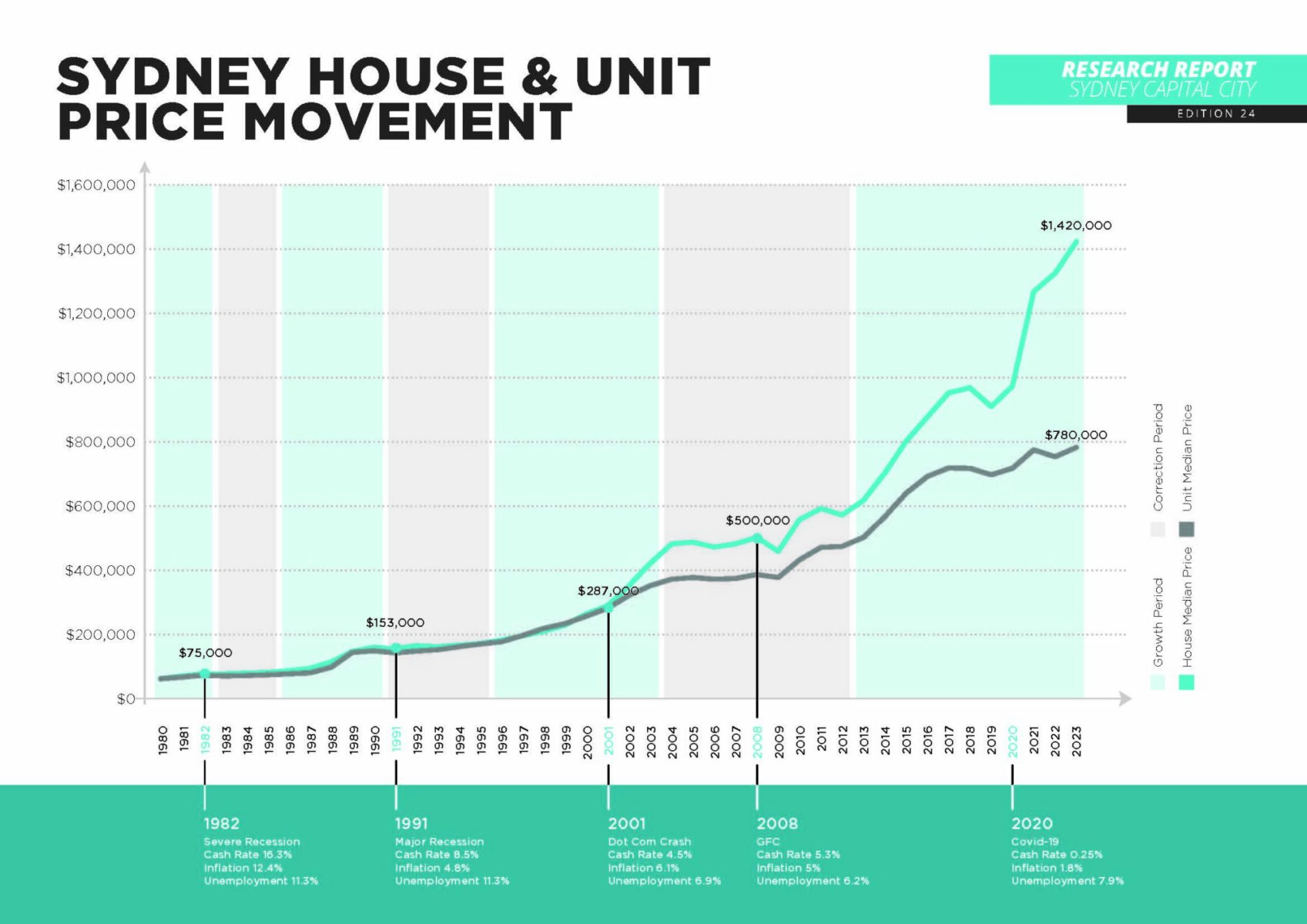

LONG TERM MARKET PERFORMANCE

If you own property in Brisbane or Sydney, the reports below are a great visual representation of the property markets performance over the past 50 years.

KEEP UPDATED

If you are on social media, please click the Instagram or Facebook logo’s below to follow our latest purchases and regular on the ground market updates.

If you are considering buying a new home, an investment property or you require assistance with managing your investment properties, please reach out to our team and we would be happy to discuss your requirements.

We hope you enjoyed our Summer Market update and we will be in touch again in Autumn with our next quarterly insights.

BRISBANE

SYDNEY

Let us empower you to buy with confidence and buy well.

Let our professional team of Buyer’s Agents go on the journey with you.