2025 Winter Market Update

Welcome to PMC’s latest edition of our Quarterly Newsletter, our Winter insights.

The Australian property market has held its ground over the past few months, showing continued strength despite cost-of-living pressures and higher interest rates.

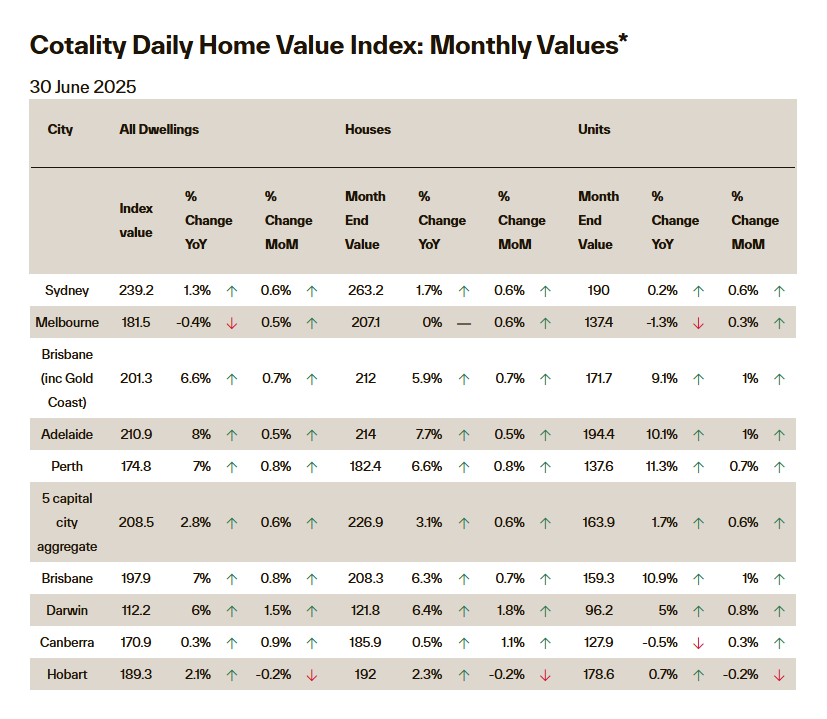

CoreLogic reports that national dwelling values rose by 0.6% in June, taking the total growth to 1.7% for the first five months of the year. Entry-level apartments and houses have been leading this growth in most capital cities, as affordability continues to drive buyer demand.

Borrowers are continuing to show impressive resilience. Mortgage arrears remain below 2% of the national loan book. CoreLogic attributes this to strong lending standards, a tight labour market, low levels of negative equity, and healthy cash buffers.

Much like we saw during COVID, the property market is proving remarkably stable in the face of uncertainty. With interest rates now beginning to ease, that resilience is likely to carry through the second half of the year.

Brisbane homeowners and investors who bought five or more years ago are generally sitting on strong equity positions. This could open doors to new investment opportunities moving forward.

Our research suggests that Melbourne is likely to enter a period of sustained growth, despite the broader economic challenges facing Victoria. Meanwhile, other capitals such as Adelaide are getting close to the top of their current growth cycle. (See below graph)

We’re also seeing construction targets falling short. With high labour and material costs, many development projects are no longer stacking up, and this is expected to keep supply constrained in the short term.

SYDNEY

Note; our commentary is specifically focused on the Northern Beach and North Shore marketplaces that we specialise in.

Looking Back on the Sydney Market in the Past Quarter

Buyer activity on the Northern Beaches remains strong in the entry-level market, with solid turnout at open homes for apartments under $1.6 million and houses under $3 million. In contrast, the prestige market, especially homes over $5 million, has quietened, likely due to global uncertainties with US tariffs and the conflicts in the middle east and Ukraine. Whilst a rate cut didn’t materialise as expected on Tuesday 8th July, entry-level buyers still seem encouraged by the prospect of future rate cuts in the second half of the year. This matches the increased enquiries we’ve seen for apartments under $1.5 million and houses under $3 million, particularly in the Northern Beaches.

There’s been a slight increase in prestige listings, but agents across the board are preparing for a quiet winter, with limited stock expected to hit the market in the coming months.

Predicting the Sydney Market Moving Forward

Looking ahead, we expect tight stock levels to continue through winter. With one or two interest rate cuts likely between now and Christmas, we anticipate this environment will support further price growth, particularly at the more affordable end of the market.

Winter tends to be a quieter season, but it often sets the stage for a busy spring. As buyers become increasingly frustrated with limited choice, we usually see a build-up of demand heading into September and October.

In the meantime, we’re ramping up our work behind the scenes, staying close to agents and getting creative to uncover off-market opportunities before spring.

BRISBANE

, Note; the comments below are for the inner-city suburbs of Brisbane and the Redcliffe peninsular

Looking Back on the Brisbane Market This Past Quarter

The past few months have been busy across Brisbane’s property market, with some clear trends starting to emerge, particularly around affordability and lifestyle.

Units under the $1 million mark have been the standout performers. With house prices still out of reach for many, buyers are turning to the unit market for better value, especially close to the city.

We’ve also seen a noticeable lift in activity around Moreton Bay, particularly on the Redcliffe Peninsula, where inspection numbers are up. The area’s coastal lifestyle and relative affordability continue to attract a broad range of buyers.

Rental yields have edged up slightly, and vacancy rates remain very low at under 2 per cent, keeping pressure on the rental market.

A major announcement last quarter was the confirmation of the new Olympic stadium at Victoria Park. Since then, there’s been a noticeable spike in interest in surrounding suburbs like Kelvin Grove, Herston and Spring Hill as buyers start to position themselves ahead of potential future growth.

Overall, demand continues to outpace supply, especially in the sub-$2 million range within 10 kilometres of the CBD. On the higher end, buyers looking above $2 million are taking more time with their decisions. They’re doing their research and not rushing in, which has led to slightly longer days on market in that price bracket.

What We’re Expecting in the Months Ahead

Looking forward, the unit market is likely to maintain solid momentum over the next six to twelve months. If the government increases the property price limits threshold for first home buyers to $1 million, it’ll only strengthen demand in this segment.

Available stock is expected to remain tight over the winter months and school holidays. With fewer properties on the market and plenty of motivated buyers, we could see prices continue to edge upward in key locations.

Townhouses in the $900,000 to $1.2 million range are expected to remain in strong demand, especially in inner-city suburbs. They offer a practical alternative for those who’ve been priced out of the housing market but still want space and location.

At the top end, there’s no shortage of buyers, but listings remain limited. The prestige market continues to be tightly held, which is helping to support strong prices.

If we do see a cut to interest rates over the next three to six months, it could give the market another push and potentially extend the growth cycle across Brisbane even further. It’ll be one to watch closely as we head into the second half of the year.

For recent stats, facts and figures on Australia’s residential property market, click here for Cotality’s (Core Logic) Monthly Housing Chart Pack.

PROPERTY CLOCKS

In partnership with other research companies, PMC analyse the 32 largest population bases (capital cities and major regional markets) in the country to assess where each market is currently situated in its cycle.

Please click the link below to gain an understanding of where we believe the current markets are placed in their property cycle.

KEEP UPDATED

If you are on social media, please follow us to stay up to date on our latest purchases and regular on the ground market updates.

BRISBANE

SYDNEY

GOLD COAST

Let us empower you to buy with confidence and buy well.

Let our professional team of Buyer’s Agents go on the journey with you.