2025 Summer

Market Update

Welcome to PMC’s latest edition of our Quarterly Market Update, our Summer insights.

National Market Update

Recent inflation data has tempered expectations of any near-term interest rate cuts, reinforcing the likelihood that borrowers will need to get used to current interest rate settings as the new norm. Some economists have even suggested that an interest rate increase in 2026 is possible if inflation gains further momentum. Should that scenario unfold, it will likely remove some of the heat that has built up in the broader national market over recent months.

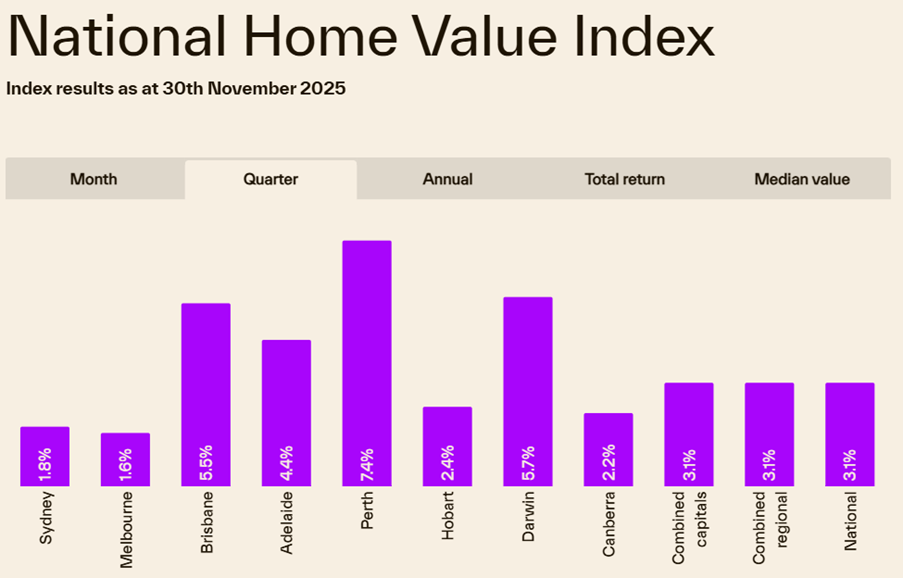

According to Cotality, national home values continued to climb, with the Home Value Index rising another 1.0 percent in November. This marks the third consecutive month of gains above one percent, although the pace of growth is beginning to moderate, easing back from the 1.1 percent recorded in October.

First Home Buyer 5% Deposit Scheme

Mortgage brokers are reporting significant delays in processing applications due to a “massive influx” of submissions for the Federal Government’s First Home Buyer 5% deposit scheme. A Westpac spokeswoman confirmed that applications under the scheme have more than doubled since 1 October, when it was expanded to allow any first home buyer with a property up to $1 million, regardless of income, to purchase with just a 5% deposit and without paying mortgage insurance, provided the bank is satisfied they can service the loan.

This surge in applications reflects strong demand from new entrants to the market and serves as a reliable lead indicator for short-term growth in the entry-level segment, as noted in our Spring quarterly update. With this government incentive, coupled with a degree of FOMO driven by expected market growth, we anticipate that activity in the entry-level apartment and housing market will remain robust through the first half of 2026, supporting both buyer activity and overall confidence in this sector.

SYDNEY

Note; our commentary is specifically focused on the Northern Beach and North Shore marketplaces that we specialise in.

Looking Back on the Sydney’s Northern Beaches Market in the Past Quarter

Sydney (and Melbourne) has continued to record auction clearance rates in the low-60% range through the second half of November. With interest rates expected to remain on hold for an extended period, and affordability already stretched, growth in the Sydney market is likely to be more modest throughout 2026.

On the Northern Beaches and Lower North Shore, conditions have been patchy. Some pockets, such as Freshwater and Curl Curl, have remained relatively buoyant, while other areas have experienced softer-than-usual activity. Entry-level apartments and entry-level houses remain the strongest-performing segments, supported by continued demand from both first home buyers and investors.

In the housing market between $2.5m and the high $3m range on the southern end of the Beaches, competition has been evident. However, the $4m+ segment has softened, with buyers more selective and willing to wait for the right opportunity.

A shortage of quality rental homes has also become more pronounced, contributing to strong weekly rents for well-presented family houses. As supply remains tight, this dynamic is likely to continue into 2026.

Predicting the Sydney Market Moving Forward

We’ve been speaking with local agents about the stock they have lined up for the new year, and early indications suggest there should be a noticeable lift in listings as we enter 2026. However, as is usually the case, once you sort through what comes to market, genuine A-grade properties are still expected to remain in short supply.

Given this dynamic, we anticipate the first quarter of next year will present as a more balanced market. C and D grade properties may trade at a perceived discount, while A- and B-grade homes are likely to attract their usual level of strong competition.

Looking ahead, buyer sentiment in 2026 will be heavily influenced by the RBA’s commentary. Any shift in tone or guidance on interest rates will play a key role in shaping confidence and activity levels across the Northern Beaches and North Shore markets.

BRISBANE

, Note; the comments below are for the inner-city suburbs of Brisbane and the Redcliffe peninsular

Looking Back on the Brisbane Market This Past Quarter

Demand over the past quarter has continued to outstrip supply, as buyers push to enter the market before the end of the year. Rental values have also continued to rise, reflecting strong growth across units, townhouses, and houses.

The new First Home Buyer Scheme that was introduced on the 1st of October, has effectively compressed four to five years’ worth of buyers, who had been saving for a 20% deposit, into the market all at once. As a result, the sub-$1 million market has become extremely competitive, and the $1 million to $1.2 million segment is also seeing heightened activity as some buyers extend themselves to avoid intense competition.

Units priced between $650,000 and $900,000 have seen the strongest movement, with some open homes attracting more than 70 groups of prospective buyers. Meanwhile, the housing market remains buoyant, and it is now almost impossible to purchase a quality free standing house within 25km of the Brisbane CBD for under $1 million. Entry-level houses in Brisbane City Council are now around $1.1 million, though sub-$1 million options still exist in parts of the Redlands and Moreton Bay, this is unlikely to last much longer.

Due to affordability constraints, many buyers who are now priced out of the housing market have shifted their focus to inner-city townhouses, which have seen strong price growth over the past quarter. Housing demand remains strong up to around the $3 million mark, with buyer activity tapering slightly beyond this point.

The prestige market (referring to properties above $5 million as our team defines it) has been performing very strongly. Over the past quarter, more than 40 properties have sold in this range, including over five sales exceeding $10 million. For context, in the entire year of 2024 there were 62 sales between $5 million and $10 million, and nine sales above $10 million. This demonstrates growing confidence in Brisbane as a major Australian city, with buyers willing to invest significant sums into the market. It also relates to the quality of a lot of new build and renovated homes in the prestige market.

What We’re Expecting in the Months Ahead

As we approach the end of the year, the market shows no signs of slowing, and we expect confidence to remain reasonably strong into the first half of 2026. While talk of no interest rate cuts, or even a potential rise next year, may slightly cool demand, the fact that demand continues to significantly outstrip supply suggests any impact will be limited.

Construction is still lagging population growth, and until this gap begins to close, it is difficult to see the end of the current growth cycle. That said, Brisbane has been in a growth phase for almost five years, so at some point the market will need to level and stabilise, as it is not sustainable to continue growing at the current pace over the long term. In the meantime, we expect the Moreton Bay region to continue increasing in value as buyers are pushed further from the Brisbane CBD to secure housing.

MELBOURNE

Looking Back on the Melbourne Market This Past Quarter

Over the past quarter, Melbourne’s property market has continued to demonstrate steady growth. House values increased by 1.6% over the quarter, with the median rising from $953,454 in September to $978,392 in November. Unit values grew by 1.5%, with the median increasing from $628,979 to $637,830 over the same period (Cotality Home Value Index). Interstate investors have continued to enter the Melbourne market, reinforcing the view that the city remains undervalued compared with other major capitals. The introduction of the Federal Government’s 5% deposit scheme for first home buyers on 1 October further stimulated demand, particularly for properties priced below $950,000 in metropolitan areas and $650,000 in regional Victoria. As predicted, this led to an immediate lift in values for properties in these price brackets.

Rising construction and renovation costs over recent years have also increased demand for turnkey family homes. Many buyers who had previously purchased with a view to renovate, extend, or rebuild are now finding it more cost-effective to pay a premium for a completed home. Properties in family-oriented suburbs, offering four or more bedrooms, multiple living areas, entertaining spaces, and swimming pools, are performing particularly well and achieving strong results.

Melbourne’s market has clearly awoken from its post-COVID slowdown. Momentum over the quarter was underpinned by a combination of interstate investors, first home buyers, and local family home upgraders. While expectations of an interest rate cut in November initially suggested a competitive surge, the Reserve Bank’s decision to hold rates has temporarily slowed some of that momentum. Looking ahead, a major point of discussion is the Victorian Government’s proposed changes to property advertising in 2026, including the publication of auction reserve prices a week prior to auction. The aim is to reduce underquoting and give buyers a more accurate sense of price expectations, a move that has sparked wide-ranging commentary across industry, government, and the buying and selling community.

What We’re Expecting in the Months Ahead

We are watching closely to see what impact the publishing of auction reserve prices will have on the property market and whether the government achieves its goal of reducing underquoting. There will be a period for agents, sellers, and buyers to adjust to these changes, and the outcomes will be closely observed. The first three months of auction results following the introduction of these laws will be particularly interesting, revealing the correlation between advertised prices, reserve prices, and final sale prices.

Meanwhile, the momentum from the back end of 2025 is expected to carry through into a strong start for 2026. Although there has been a slight pause in momentum, agents are reporting a healthy number of listings expected to come onto the market in February and March, as buyers typically return from the new year ready to secure a new home or investment.

This should continue to give sellers confidence to list their properties, increasing buying opportunities across the market. Off the back of the government’s deposit scheme for first home buyers, we also expect continued demand and growth in well-located boutique apartments and units, a trend that hasn’t been seen in a decade. At the same time, well-located, well-presented family homes are likely to remain highly competitive, maintaining strong buyer interest.

SUNSHINE COAST

Looking Back on the Sunshine Coast Market This Past Quarter

The Sunshine Coast spans 3,125 square kilometres and includes a diverse mix of suburbs across two main council areas: Sunshine Coast and Noosa. The region is broadly divided by the Maroochy River, which separates the northern and southern parts of the Coast, and much of the major infrastructure investment underway has been directed south of the river. This has sparked strong interest from both home buyers and investors, drawn by proximity to Brisbane, new developments, and comparatively more affordable housing options. Investors, in particular, are targeting the region for its above-average rental yields, extremely low vacancy rates, and strong long-term growth prospects. North of the Maroochy River, tightly held beachside suburbs such as Noosa Heads and Sunshine Beach continue to show strong growth expectations due to limited supply and enduring prestige appeal, while the broader Coast remains a leading choice for international and interstate relocators seeking lifestyle advantages and a favourable climate. According to Proptrack, demand is exceptionally high in Shelley Beach, Dicky Beach and Marcus Beach, all of which ranked in the top 10 suburbs nationally for average enquiries per listing in 2025.

Overall, the Sunshine Coast property market has demonstrated strong and sustained momentum across both houses and apartments. High demand, limited supply, and elevated levels of interstate migration have contributed to double-digit annual price increases through late 2024 and into mid-2025, with houses leading but apartments also performing strongly. Forecasts point to steady, ongoing appreciation into 2026, supported by these solid fundamentals.

Over the past quarter, investor activity has strengthened as the region offers both consistent long-term capital growth and strong rental returns, outperforming some of the capital city markets that are beginning to soften. The introduction of first-home buyer incentives has further stimulated demand, contributing to meaningful price increases across key segments of the Sunshine Coast market.

What We’re Expecting in the Months Ahead

Looking ahead, the Sunshine Coast market is expected to continue growing as population increases and major infrastructure projects progress. Key infrastructure developments supporting this outlook include the $170 million Sunshine Coast Airport Terminal redevelopment, the passenger rail extension from Beerwah to Birtinya with new stations at Bells Creek (Aura), Caloundra, Aroona, and Birtinya, an express metro service connecting Birtinya to Maroochydore CBD and the airport, the Mooloolah River Interchange upgrade, and the Maroochydore City Centre priority development area. These projects are expected to enhance accessibility, create jobs, and support long-term demand.

GOLD COAST

Looking Back on the Gold Coast Market This Past Quarter

Gold Coast property prices have increased by 10.06% over the past year, reaching a new median high of $1.107 million. Experts are predicting further gains, and PropTrack’s latest Home Price Index shows the Glitter Strip now has the second-highest median in the country, behind only Sydney at $1.228 million.

The southern end of the Gold Coast has seen slower growth for houses over the last quarter, with most suburbs recording changes in value under 3%. Suburbs such as Mermaid Waters, Burleigh Waters, and Currumbin have experienced slight declines, while Currumbin Waters (3.5%) and Elanora (3.1%), along with central areas like Merrimac (5.4%), Carrara (4.2%), and Worongary (3.2%), performed relatively well. In contrast, the northern Gold Coast continues to experience stronger growth, with most suburbs recording increases above 3%. Top performers include Oxenford (8%), Upper Coomera (7%), Maudsland (7%), Coombabah (6.6%), and Helensvale (4.7%). This illustrates a clear north–south affordability split, with median house values in many central and southern suburbs now exceeding $2 million, while northern suburbs remain largely below $1.3 million.

Unit prices follow a similar pattern. Southern suburbs have experienced slower growth, with affordability again being a key factor. Ashmore and Varsity Lakes were the strongest performers, rising 7.3% and 8.1% respectively. Northern suburbs mostly saw growth between 3–6%, while many southern suburbs remained in the 0–3% range. Median unit values in many southern suburbs, south of Broadbeach, have now surpassed $1 million, whereas northern suburbs generally remain under $900,000. Merrimac, Ashmore, Nerang, Oxenford, and Coombabah are among the most affordable areas for units on the Gold Coast. As of October 2025, the Gold Coast’s median unit price of $956,000 overtook Sydney’s $927,000 for the first time, recording a 10-year growth rate of 101% according to Ray White data. While units on the Gold Coast were previously more volatile, growing population and limited new supply have brought increased stability to the market.

Rents on the Gold Coast remain strong, with median weekly rents for houses surpassing $1,000 and units exceeding $700.

What We’re Expecting in the Months Ahead

As population growth continues to accelerate and the expanded Home Guarantee Scheme encourages additional buyer activity, conditions in the property market are expected to remain firmly weighted in favour of sellers. We anticipate further price growth over the course of 2026, though likely at a more measured pace compared with the increases seen in recent years.

While the overall outlook for the market remains positive, it is becoming increasingly fragmented. Individual suburbs and precincts are likely to perform very differently, influenced by local economic conditions, the availability of supply, and changing buyer preferences. Some areas will see strong demand and continued growth, while others may experience slower movement or stabilisation. Successfully navigating this more complex and varied market requires careful strategy, deep local knowledge, and expert representation.

NEWCASTLE

Looking Back on the Newcastle Market This Past Quarter

The recently released NSW Valuer General land values, as of 1 July 2025, show that residential land values in Newcastle have risen 7% compared with the previous year, well above the state average of 4.2%. This growth is underpinned by the city’s appeal as a prestige coastal lifestyle destination and strong demand from first home buyers seeking more affordable markets. Newcastle continues to evolve as an international hub for tourism and development, supported by new international flights to Bali and Singapore, as well as domestic connections to Tasmania and Western Australia, enhancing accessibility, employment opportunities, and overall liveability. The ongoing desire for an affordable coastal lifestyle, combined with access to world-class amenities and services, continues to drive significant migration from both Sydney and rural NSW. This increased demand, together with stock levels approximately 20% lower than this time last year, has resulted in strong competition and substantial price growth for quality properties, particularly those priced under $1.5 million.

What We’re Expecting in the Months Ahead

Current low stock levels, combined with ongoing market stimulation, are expected to support a strong property market into 2026. Large-scale developments, such as the Broadmeadow Place Strategy approved last year, along with the proposed high-speed rail link between Sydney and Newcastle, are projected to create thousands of new jobs and further stimulate the local economy over the medium to long term. These initiatives are likely to enhance the city’s long-term appeal, increasing both investment and demand for people looking to live in Newcastle.

Key Takeaways

National

National home values continue to rise, interest rates are likely to stay high for longer, and the First Home Buyer 5% Deposit Scheme is driving strong entry-level demand.

Sydney (Northern Beaches)

Entry-level homes and apartments remain in demand, while higher-end properties soften, and rental shortages continue to support strong rents.

Brisbane

Demand far exceeds supply, pushing buyers into competitive markets under $1 million, with townhouses and prestige properties also seeing strong activity.

Melbourne

Steady growth is being driven by interstate investors, first home buyers, and family home upgraders, with upcoming auction reserve legislation set to influence the market.

Sunshine Coast

Steady growth is being driven by interstate investors, first home buyers, and family home upgraders, with upcoming auction reserve legislation set to influence the market.

Gold Coast

Steady growth is being driven by interstate investors, first home buyers, and family home upgraders, with upcoming auction reserve legislation set to influence the market.

Newcastle

Limited stock, strong coastal lifestyle appeal, and major infrastructure projects are supporting significant price growth and ongoing demand.

For recent stats, facts and figures on Australia’s residential property market, click here for Cotality’s (Core Logic) Monthly Housing Chart Pack.

PROPERTY CLOCKS

In partnership with other research companies, PMC analyse the 32 largest population bases (capital cities and major regional markets) in the country to assess where each market is currently situated in its cycle.

Please click the link below to gain an understanding of where we believe the current markets are placed in their property cycle.

KEEP UPDATED

If you are on social media, please follow us to stay up to date on our latest purchases and regular on the ground market updates.