2025 Spring Market Update

Welcome to PMC’s latest edition of our Quarterly Market Update, our Spring insights.

The Government Has Just Ramped Up Price Growth Expectations

At PMC, we monitor the Australian property market closely to help our clients make informed buying and investment decisions. With recent policy changes and shifts in market sentiment, there’s plenty happening across the nation that buyers and investors need to be aware of.

National Market Update

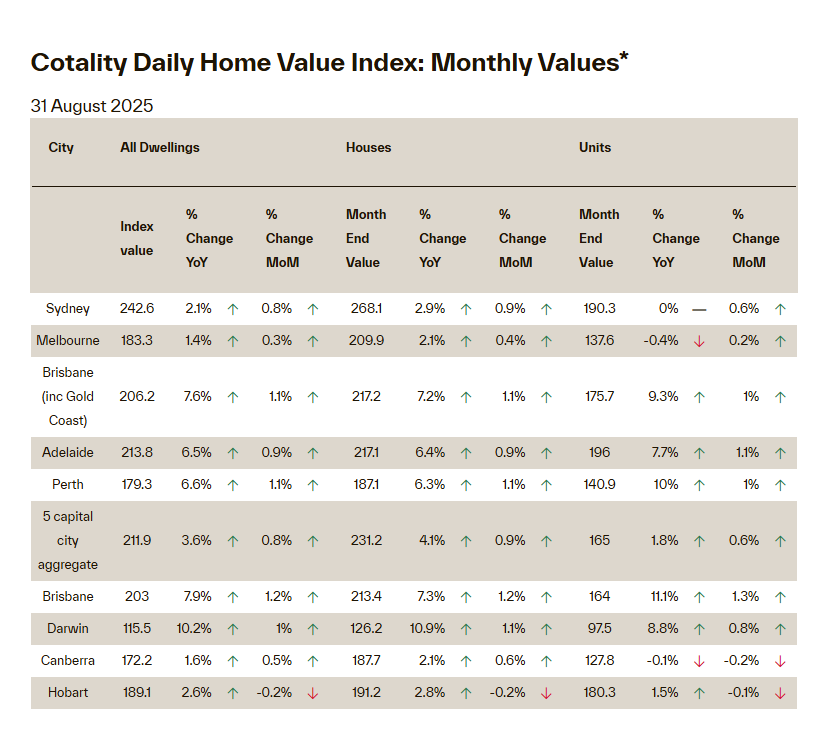

Australia’s property market has continued its upward momentum over the past quarter, supported by falling interest rates and renewed buyer demand. Investor enquiry has noticeably increased, with many looking to capitalise on expected growth. Market sentiment has turned positive, and in some cases, buyer FOMO is creeping back in as people anticipate further price rises.

Over the past 12 months, all capital city markets have recorded growth in dwelling values, further reinforcing confidence among buyers and investors alike. South-East Queensland remains a standout for investors, though interest in Melbourne is strengthening, with signs of an early recovery cycle taking shape.

First Home Buyer 5% Deposit Scheme – What’s Changing?

From 1 October 2025, the Federal Government will roll out substantial changes to the First Home Buyer 5% Deposit Scheme. Income limits will be removed, price caps will be significantly increased, and borrowing capacity will be lifted. Sydney’s cap will jump from $900,000 to $1.5 million, while Brisbane’s will rise from $700,000 to $1 million.

Under the scheme, eligible buyers only need a 5% deposit, with the government guaranteeing the remaining 15%, eliminating the need for Lenders Mortgage Insurance (LMI). These changes are expected to spark strong competition below the new price caps, as both first home buyers and investors target this segment of the market. In the short term, this policy is likely to place upward pressure on prices across the country. In our opinion, this is just adding more pressure on the demand side of the equation, whereas there should be a greater focus on the supply side.

Australian Property Snapshot

|

Metric |

Value / Forecast |

|

National Dwelling Value |

3 months 1.8% up, 12 months 4.1% – now $848,858 |

|

Top Performing Cities |

Darwin (10.2%), Brisbane (7.9%), Perth (6.6%) |

|

Brisbane |

3.0% up last quarter, 7.9% up past 12 months – the market is still performing strongly in its later stages of its growth cycle |

|

Melbourne |

1.0% up last quarter, 1.4% up past 12 months – early stages of its recovery and likely the start of its next growth cycle |

|

Sydney |

1.7% up last quarter, 2.1% up past 12 months – we expect modest growth to continue especially around the entry level prices for houses and units |

|

Next 12 Month Forecast |

Expecting growth to continue across most markets, particularly at the first home buyer price points due to the recent government stimulus |

|

Rental Market |

Rents are up 4.1% over the year to August |

|

Rental Yields |

3.7% national gross rental yields, combined capitals 3.5%, combined regionals 4.4% |

|

Interest Rate Outlook |

RBA easing expected to continue, although tempered views with latest economic data |

Source: Cotality

SYDNEY

Note; our commentary is specifically focused on the Northern Beach and North Shore marketplaces that we specialise in.

Looking Back on the Sydney’s Northern Beaches Market in the Past Quarter

On Sydney’s Northern Beaches, quality stock has remained tight and enquiry levels have been consistently strong. The shift in sentiment over the past quarter has been notable, driven by lower interest rates and the anticipation of government incentives. Many buyers are eager to secure property before the end of the year, wary of potential price growth and limited stock availability.

Predicting the Sydney Market Moving Forward

Looking ahead, activity is set to accelerate. Mortgage brokers, inspectors, and conveyancers are all reporting busy pipelines – a strong indicator of heightened market activity in Spring and beyond. Once the deposit scheme changes take effect, properties priced under $1.5 million are expected to experience the strongest demand. However, it’s not just first home buyers who will be active. Investors are also eyeing opportunities in this bracket, which may further intensify competition.

BRISBANE

, Note; the comments below are for the inner-city suburbs of Brisbane and the Redcliffe peninsular

Looking Back on the Brisbane Market This Past Quarter

Brisbane’s market has been equally competitive, particularly for properties up to $1.5 million within a 10–12 kilometre radius of the CBD. Units and townhouses have been the standout performers, with heightened demand in the sub-$1 million price bracket as buyers rush to act before the new scheme comes into play. Stock remains limited, and with some architects now booked out 18–24 months, build times are blowing out from two years to three or four. This delay has shifted some prestige buyers toward purchasing new builds rather than taking on renovations.

What We’re Expecting in the Months Ahead

In the months ahead, we expect unit and townhouse markets up to $1.2 million to continue performing strongly. Investor interest is being fuelled by the infrastructure pipeline leading up to the 2032 Olympics, and rental demand remains firm thanks to population growth and limited new supply. Outer areas such as Moreton Bay and the Bayside regions are drawing more attention as buyers seek affordability, while some investors are looking further afield to the Gold and Sunshine Coasts, where yields are 1–1.5% higher than Brisbane.

Key Takeaways

National

Momentum is building across all capital cities, with investors increasingly active and RBA easing supporting growth.

The new 5% Deposit Scheme (from 1 October 2025) removes income limits, increases price caps, and guarantees 15% of the deposit, driving short-term competition and likely price growth below cap levels.

Sydney (Northern Beaches)

Tight stock and strong enquiry suggest heightened activity into Spring. Sub-$1.5 million properties will see the strongest demand, with both first home buyers and investors competing.

Brisbane

Units and townhouses under $1.2 million are expected to perform strongly. Infrastructure projects and population growth continue to fuel investor demand. Outer regions and coastal areas are benefiting from affordability pressures.

Outlook

With national growth momentum, government stimulus, and easing interest rates all working in tandem, the Australian property market is set for a busy final quarter of 2025. Competition is expected to be strongest in the entry and mid-tier price points. At PMC, we continue to monitor these trends closely to provide our clients with strategic insights and advice. Buyers who are well-prepared and ready to act will be best placed to secure opportunities in what is shaping up to be a highly competitive market.

For recent stats, facts and figures on Australia’s residential property market, click here for Cotality’s (Core Logic) Monthly Housing Chart Pack.

PROPERTY CLOCKS

In partnership with other research companies, PMC analyse the 32 largest population bases (capital cities and major regional markets) in the country to assess where each market is currently situated in its cycle.

Please click the link below to gain an understanding of where we believe the current markets are placed in their property cycle.

KEEP UPDATED

If you are on social media, please follow us to stay up to date on our latest purchases and regular on the ground market updates.

BRISBANE

SYDNEY

GOLD COAST

Let us empower you to buy with confidence and buy well.

Let our professional team of Buyer’s Agents go on the journey with you.